Overspending

Overspending means to spend more than you planned for a category.

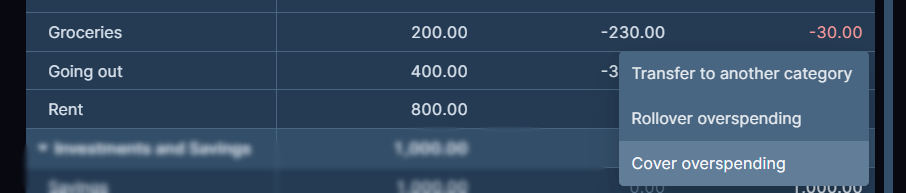

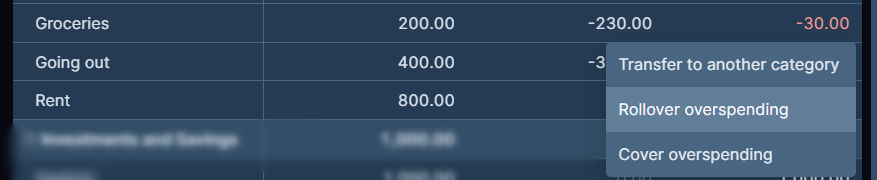

When this happens you have 3 options:

- Move money from another category to the overspent category

- Rollover the negative balance of the category to the next month

- Do nothing and take the hit in next month budget

Let's take a look at them in detail.

Cover with another category

You can cover your overspending by moving money from one category to another. For example, if you overspent this month on Groceries and underspent on Going out, then you can cover the overspending with the money you didn't use.

It's recommended to handle overspending this way because you are still planing and spending with money you actually have.

Rollover to next month (same category)

Another possibility is to pass over the negative balance of the overspent category to next month. This way, you will start next month with a minus balance for that specific category. This is what we call Rollover overspending.

By using rollover, you are budgeting today with the money of tomorrow. It's not recommended to do this repeatedly. Instead, try to adjust your budget for next month to reflect your actual spendings.

Take the hit in next month whole budget

Last option to handle an overspending is to do nothing and leave the negative balance for the category. By doing this, you will start next month with that negative balance for the whole budget (not only the overspent category).

This is possible but strongly recommended against, because you lose track of where you overspent. With rollover, you at least will see next month that you went crazy on Groceries last month.